how to change how much taxes are taken out of paycheck

You need to submit a new W-4 to your employer giving the new amounts to be withheld. IR-2018-127 Law change affects moving.

Paycheck Calculator Online For Per Pay Period Create W 4

These are contributions that you make before any taxes are withheld from your paycheck.

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. For self-employed individuals they have to pay the full percentage themselves. How to have less tax taken out of your paycheck.

Three types of information an employee gives to their employer on Form W4 Employees Withholding Allowance Certificate. How Much Tax Is Deducted From My Paycheck Ontario 2021. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

An amount over 45142 is taxed at 9142 up to 90287. If you changed your tax withholding mid-year. How to Change How Much Taxes Are Taken Out of Paycheck.

To do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Child birth or adoption. If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on.

Combined the FICA tax rate is 153 of the employees wages. An example of how this works. We highly recommend outsourcing your payroll to a company like Gusto.

In amounts up to 150000 the tax rate is 11 percent. Increase the number of dependents. How much is payroll tax in PA.

Increase the number on line 4 b. The first step is filling out your name address and Social Security number. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

If too little is being taken increase the withheld amount. There is a 14 percent tax rate for earnings of 150000 up. Employers are required to withhold PA personal income tax at a flat rate of 307 percent of compensation from resident and nonresident employees earning income in Pennsylvania.

A Form W-4 officially titled Employee Source Deduction Certificate is an IRS form that employees use to tell employers the amount of tax to withhold on each paycheck. According to the Ontario tax rates for 2021 the amount earned up to 45142 is taxed at a rate of 5. How withholding is determined.

Both employee and employer shares in paying these taxes each paying 765. Payroll tax is complex. The calculations are nitpicky and penalties are steep.

In 2021 you can contribute up to 19500 a year to a 401 plan. To adjust your withholding is a pretty simple process. For a single filer the first 9875 you earn is taxed at 10.

New job or other paid work. A few other notable facts about 401 contributions. This rate remains in effect unless you receive notice of a change from the Department of Revenue.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Reduce the number on line 4 a or 4 c. When you have a major life change.

How do I withhold less taxes on 2020. Combined the FICA tax rate is 153 of the employees wages. IR-2018-222 IRS provides tax inflation adjustments for tax year 2019.

Only the very last 1475 you earned would be taxed at. Do any of your employees make over 137700. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck.

When you file your tax return youd report 48000 rather than 50000. Number of withholding allowances claimed. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

Factor in additional income and deductions. Employers use the W-4 to calculate certain payroll taxes and transfer taxes to the IRS and the state on behalf of. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Enter your personal information. The amount of income earned and. The amount withheld depends on.

Check your tax withholding every year especially. Even paying payroll taxes just a day late comes with a 2 penalty on the amount due with that penalty rising as high as 15 for past due payroll taxes. Multiple jobs or spouse works.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. If too much tax is being taken from your paycheck decrease the withholding on your W-4. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

Either the single rate or the lower married rate. Check your tax withholding at year-end and adjust as needed with a new W-4. About Employer Withholding Taxes.

Understanding Your Paycheck Credit Com

Important Tax Information Work Travel Usa Interexchange

How To Fill Out Form W 4 W4 Withholding Allowances Taxact

Check Your Paycheck News Congressman Daniel Webster

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

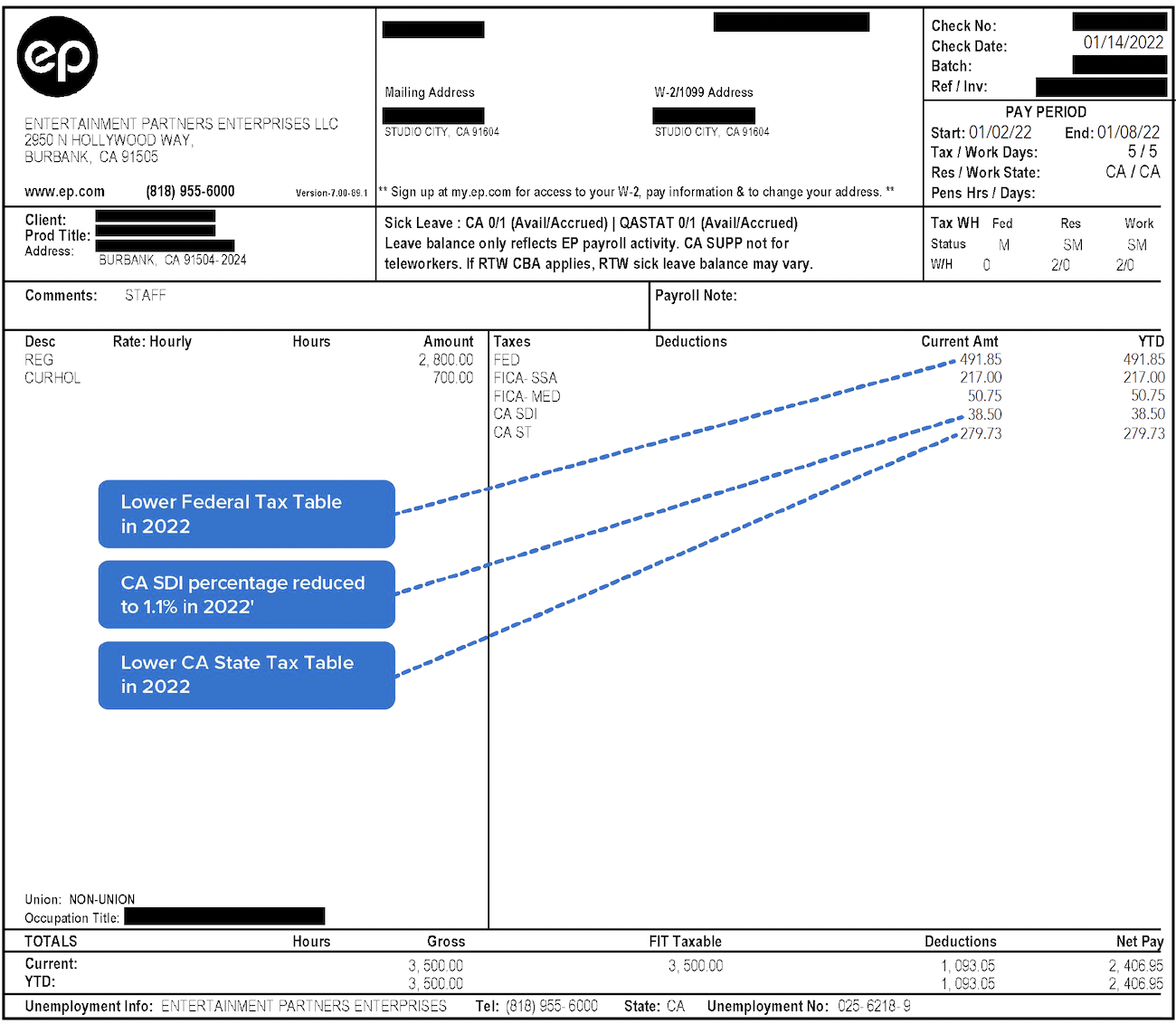

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Different Types Of Payroll Deductions Gusto

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Irs New Tax Withholding Tables

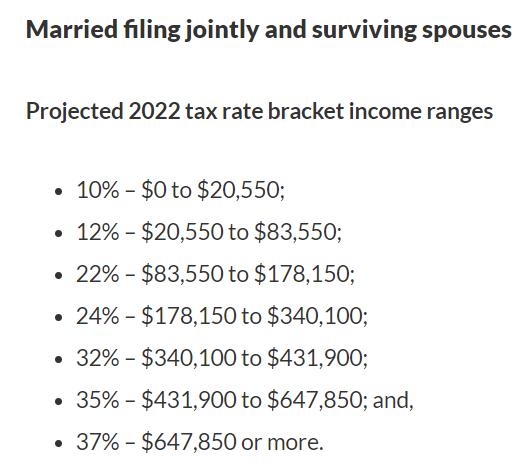

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Decoding Your Paystub In 2022 Entertainment Partners

What Are Payroll Deductions Article