capital gains tax philippines

Gains from the sale are considered Philippine-source income and are thus taxable in the Philippines regardless of the place of sale. A Capital Gains Tax is imposed on the gain that the seller gets from a sale exchange or other transfer of capital assets that are located in the Philippines.

Capital Gains On Inherited Property

Philippines capital gains tax.

. According to the Philippine Tax Code Capital Gains Tax is a tax that is imposed on earnings that the seller has gained from the sale. Capital positive factors tax on sale of actual property positioned within the Philippines and held as capital asses is predicated on the presumed positive factors. 1 In General.

Capital gains tax otherwise due thereon 6 P 300000. A person is exempted from capital gains tax if the. Gain from dealings of regular assets.

The property is directly and jointly owned by. To calculate the capital gains tax you check. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing.

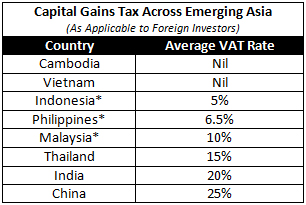

Philippines capital gains tax is calculated at i 15 of the net capital gains realised during the taxable year from sale barter exchange or other disposal of. Capital gains tax CGT is imposed on both. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

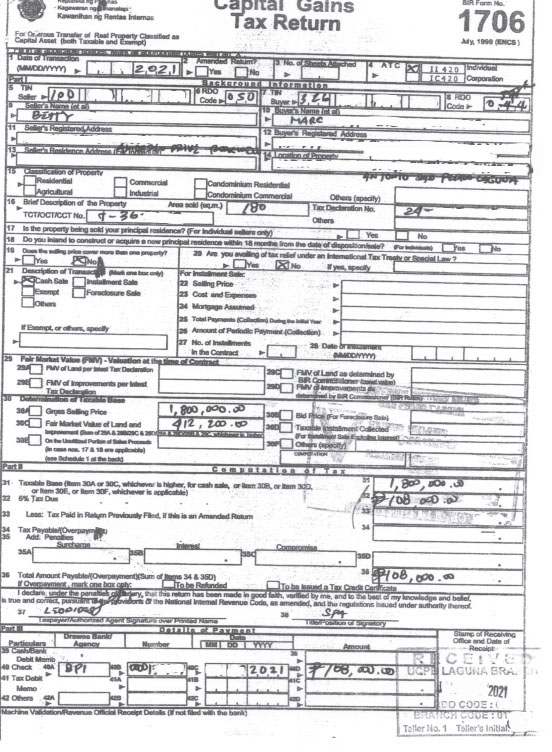

- The provisions of Section 39 B notwithstanding a final tax of six percent 6 based on the gross selling price. Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines. This is not necessarily the case.

However gains realized by a domestic corporation or a resident foreign corporation on the sale of shares in a domestic corporation that is not. Capital gains tax allocable to the unutilized portion 75000. Capital Gains Tax vs.

Capital gains taxes. What is Capital Gains Tax in the Philippines. When there is a sale of real estate automatically people think that they have to pay Capital Gains Tax CGT.

According to the National Bureau of Internal Revenue section 24D the capital gains tax rate is 6 of the propertys selling price. Amount of exempt capital. Capital gains generally are taxed as income.

In the Philippines there are valid reasons that allow real estate sellers to exempt themselves from the capital gains tax. D Capital Gains from Sale of Real Property.

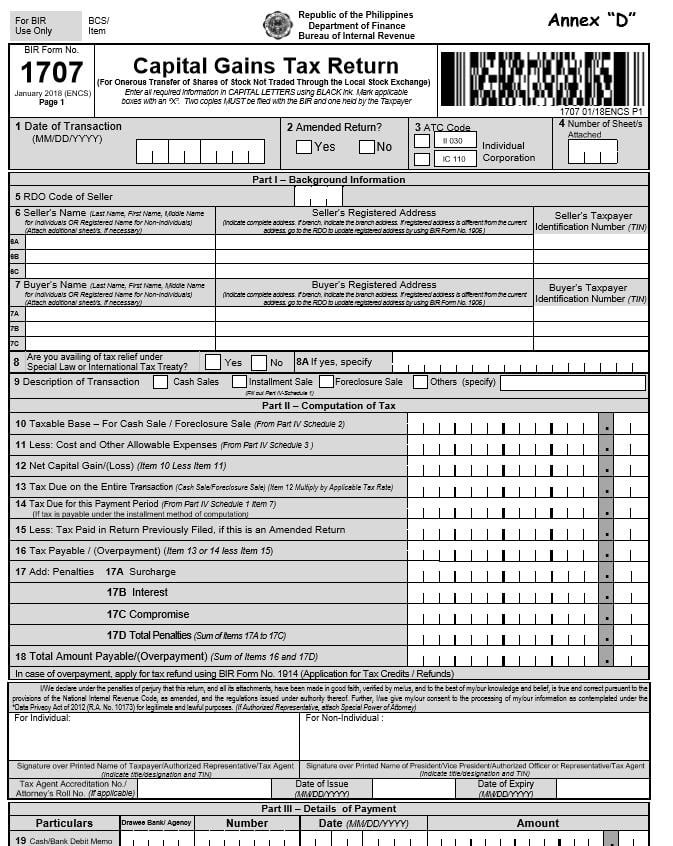

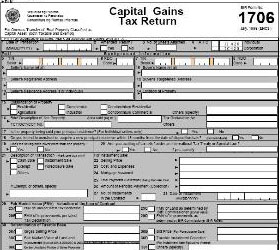

Capital Gains Tax How To Fill Up Bir Form 1706 Youtube

Capital Gains Tax China Briefing News

Capital Gains Tax Exemption Philippines With Sample Computations Youtube

Capital Gains On Selling Property In Orlando Fl

Duterte S Economic Managers Not Concerned About Below Target Yield From Train Gma News Online

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

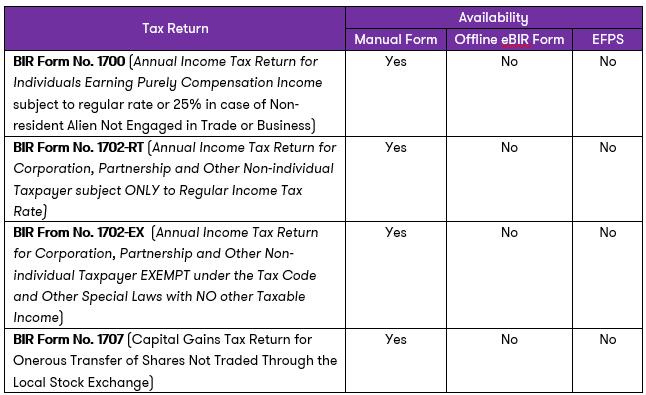

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital Gains Yield Cgy Formula Calculation Example And Guide

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

Capital Gains Tax What Is It When Do You Pay It

Income Tax Law Changes What Advisors Need To Know

Taxes And Title Transfer Process Of Real Estate Properties This 2021

Chile Indirect Transfer Of Assets And New Withholding Provisions

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines