are assisted living expenses tax deductible in canada

Assisted living expenses are deductible when a doctor has certified a patient cant care for themselves. Can incontinence supplies be tax deductible.

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

As long as the resident meets the IRS.

. Yes in certain instances nursing home expenses are deductible medical expenses. As we mentioned earlier in order for any of your assisted living expenses to be considered tax-deductible medical expenses they must exceed the IRSs threshold of 0075. Internal Revenue Service guidelines Publication 502.

For those living in assisted living communities part or all of the living expenses may qualify for a medical-expense deduction. If a resident is living at an assisted living facility for custodial care there might be specifications that qualify the expenses to be tax-deductible. Solution found If you or your loved one lives in an assisted living community part or all of your assisted living costs.

Tax Deductions for Assisted Living. There has been encouraging news from the latest 2017 US. They explained that the individual must be certified as chronically ill for assisted living expenses to be considered tax-deductible which is defined in two ways.

For information on claiming. The cost of incontinence. For information on claiming attendant care and the disability amount see the chart.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. What Portion Of Assisted Living Is Tax Deductible. In order for assisted.

According to IRS Revenue Procedure 2019-44 a couple age 70 or older who both have the. Medical expenses generally make up at least a portion of the monthly service fees and entrance fees at assisted living communities. Special rules when claiming the disability amount.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire. There are special rules when claiming the disability amount and attendant care as medical expenses. To qualify the long-term care services must involve personal care services such as.

The resident at the assisted living community must also have been certified chronically ill within the previous tax year by a professional and licensed healthcare expert. An assisted living resident. Which assisted living costs are tax deductible.

The Health Insurance Portability and Accountability Act also known as HIPPA directs that qualified long-term care services are tax deductible. For information on claiming. 2020 Tax Deductible Limits For Long-Term Care Insurance Announced.

Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that you paid. Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some. Independent living expenses are not generally tax deductible unless you live in a Life Plan community sometimes referred to as a continuing care retirement community.

16 Real Estate Tax Deductions For 2022 2022 Checklist Hurdlr

How Can I Reduce My Taxes In Canada

My Mom 76 Is In Assisted Living And Owns A Rental Home How Can We Use It To Fund Her Long Term Care And Reduce Capital Gains Marketwatch

Are Assisted Living Costs Tax Deductible Ask After55 Com

Does Medicaid Pay For Assisted Living A Place For Mom

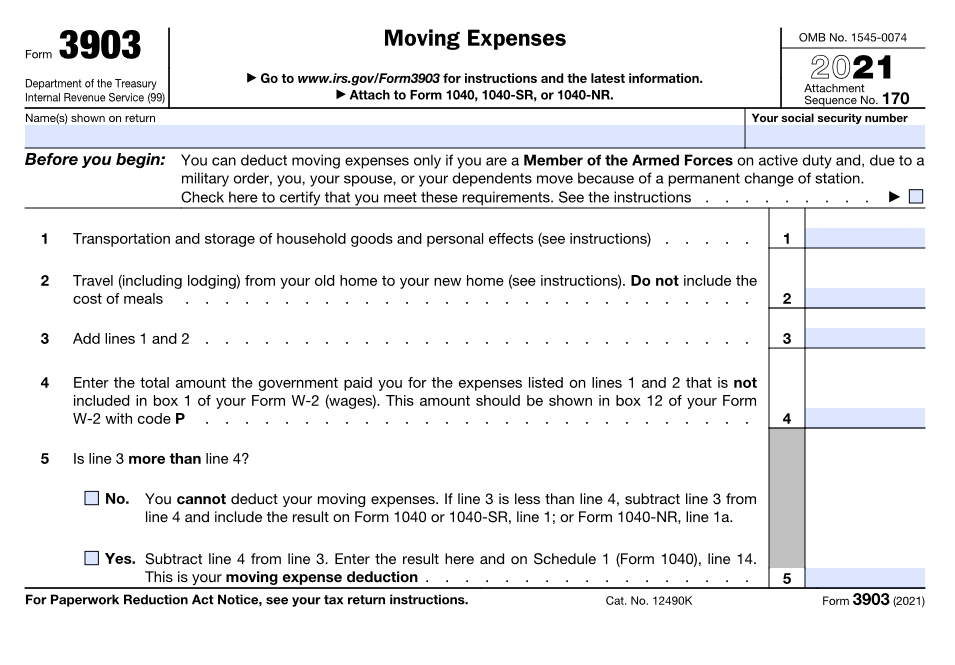

New Tax Twists And Turns For Moving Expense Deductions

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Multi Level Marketing Company The Tax Considerations Independent Sales Reps Need To Know Hawkins Ash Cpas

Can I Deduct Elder Care For My Mom On My Tax Return

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service

Independent Contractor Expenses Spreadsheet Free Template

Turn Your Personal Medical Expenses Into 100 Corporate Expenses

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

![]()

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

What Portion Of In Home Caregiver Expenses Is Deductible As A Medical Expense

:max_bytes(150000):strip_icc():gifv()/universal-health-care-4156211_final-5737902ad86c462e930875d1c0878130.png)